Whether you’re setting up your first budget or just want to refresh your finances, one of these proven budgeting techniques will work for you!

Creating and following a personal budget is one of the best ways to take steps towards financial freedom. While budgeting techniques may vary, they all require the same foundational practices: looking at the big picture, tracking your spending, and setting goals. It’s important to take all of these elements into account before choosing a technique that will work best for your financial situation.

Let’s explore some of the most popular budgeting techniques.

1. The Snowball Method

Made famous by finance guru, Dave Ramsey, the snowball method is centered around the concept of paying off debt from smallest debt to largest. Just like debt can snowball out of control from interest, you can get your debt back under control by thinking about it inversely.

This debt reduction strategy advises that you pay off your smallest debt first – often requiring you to pay more than the minimum required paymeSo Which Technique is Right for You?nt each month. Once this payment is paid off, you apply the money previously allotted to this bill to the next smallest debt – and so on and so forth. As more debts are paid off, you will have more money to put towards your large debt – hence the snowball effect.

2. Budgeting to Zero

Whether you live “paycheck to paycheck” or have more of a financial cushion, zero-based budgeting helps you account for every single dollar. It looks at your finances beyond bills and incorporates surprise expenses and savings. The idea is to allot all of your income to a spending category so that there are no dollars left over once the budget is complete. Start with your bills, then divide your extra cash into spending categories. Take what’s left over and put it towards savings and investments. This will help you stay on top of your debt as well as curb unnecessary spending.

3. 50/20/30 Rule

While the 50/20/30 rule, made popular by Senator Elizabeth Warren, is essentially budgeting to zero, it gives you a little more flexibility than the zero-based budget technique because the categories are less defined. At its core, this technique advises you to divide your income between 50% of spending on NEEDS, 30% of spending on WANTS, and allocating the remaining 20% to savings.

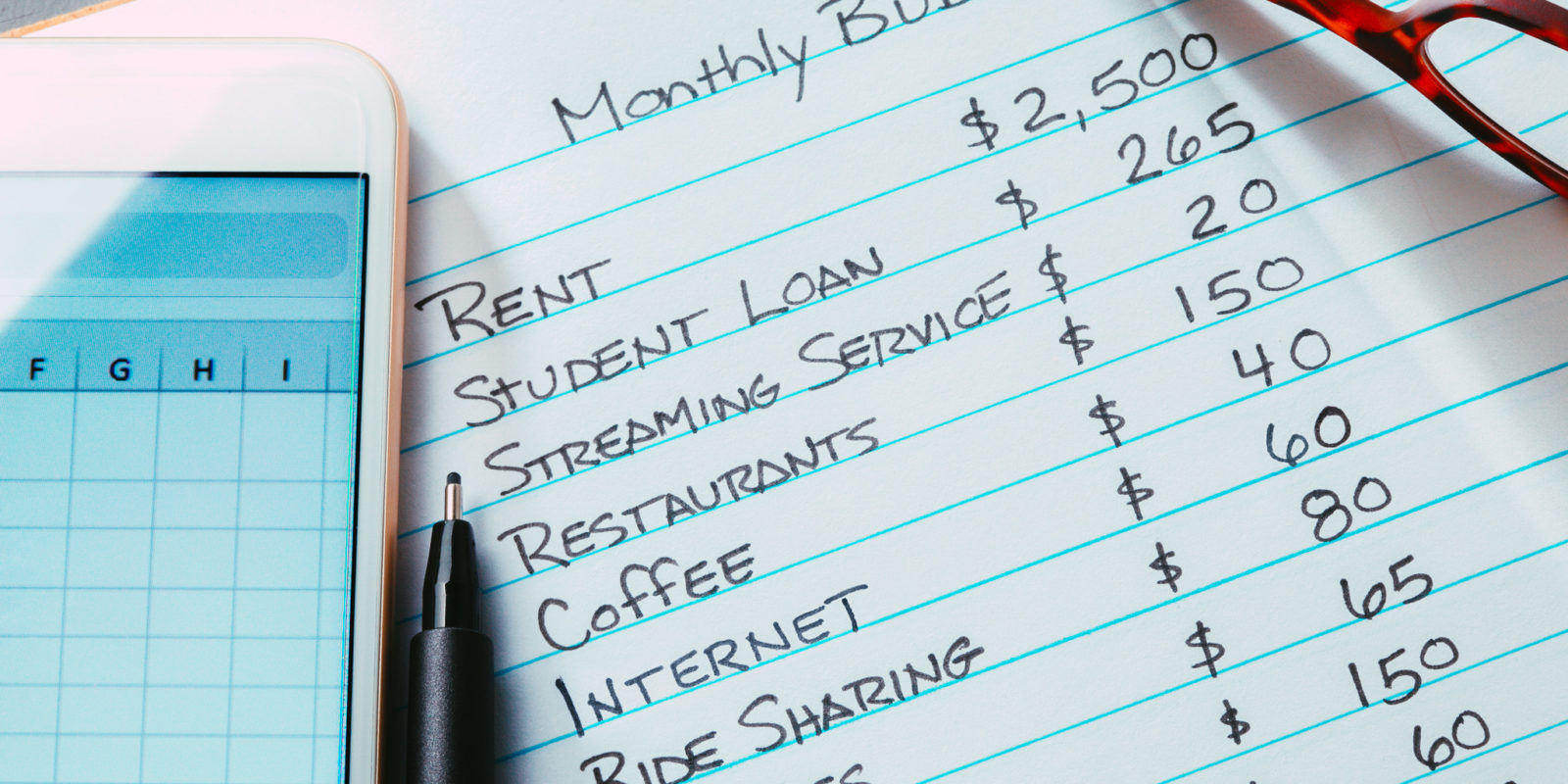

So what is categorized as a need? Your monthly bills like rent or mortgage, utilities, insurance, and debt payments. Wants include your subscription accounts, that extra trip to the local coffeeshop, and date nights out. Having a 30% chunk of “wants” spending gives you a little bit more flexibility in your spending. It also helps you account for a fixed percentage of your budget for savings.

So Which Technique is Right for You?

There are a few ways to identify the right budgeting option for you. If getting out of debt is a top priority, it’s likely that the snowball method is your best option. If you don’t have a lot of wiggle room in your budget and need structure to keep you on track, you may want to consider zero-based budgeting. If you want to prioritize savings and enjoy a little flexibility in your spending, the 50/30/20 will work best for you.

To get started choosing a budget that works for you, use your Highlands Community Bank online banking and mobile app to track and analyze your spending. If you haven’t signed up for electronic banking yet, ask your teller how!